I have come across some unique requirements for payment days especially for vendors so I wanted to do a deep dive on the functionality of payment days for Dynamics 365 Finance and Operations and show you some examples that will illustrate how payment days works.

What Are Payment Days?

Due dates for invoices are typically calculated using the terms of payment which specifies the number of days or months from the invoice date that payment is due. You have variations of this where you can select “Current year”, “Current month”, “Current quarter” which extends the due date to whatever your selection was plus however many months and days you specify.

Payment days allows you to get more granular with the actual day that the due date falls on. In this article I will go through how to use payment days in Dynamics 365 Finance and Operations.

Setup

Payment Days

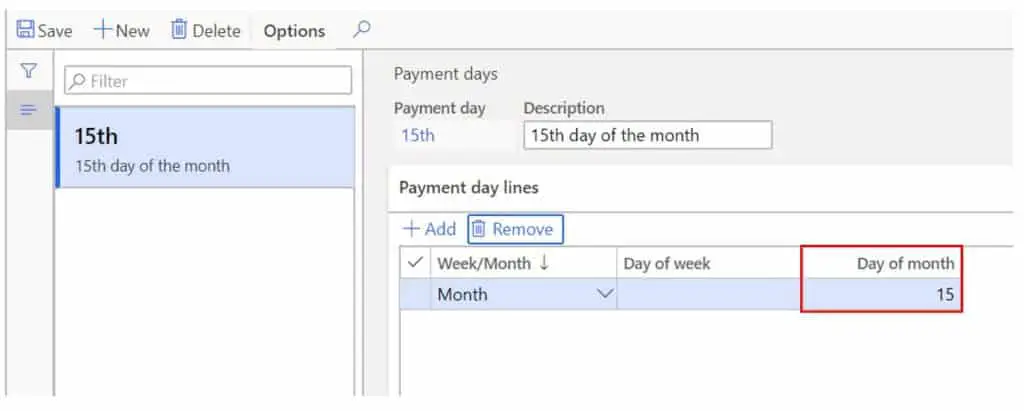

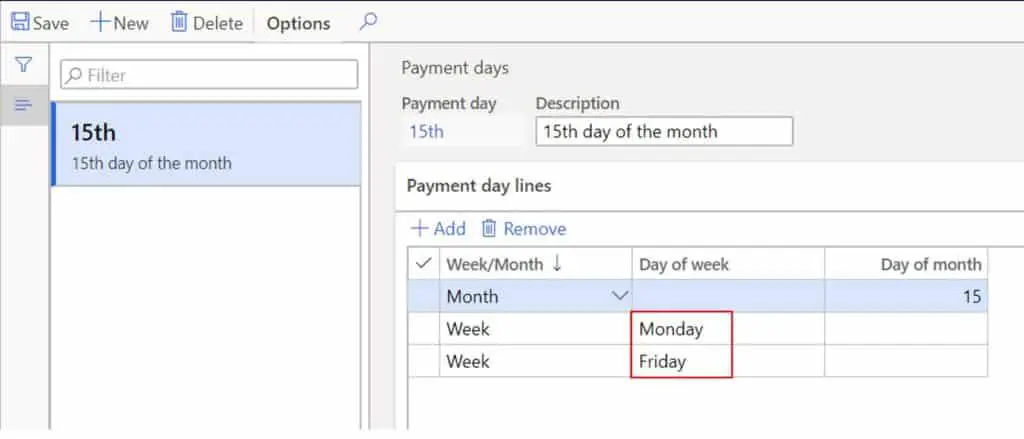

The “Payment Days” form is a pretty straight forward form but the fact that you can add multiple records in the “Payment day lines” makes it a little unclear on how it works in practice. For example what happens if you have multiple “Day of the week” or “Day of the month” records how does that affect the calculation of the due date. Later in the article we will go through that.

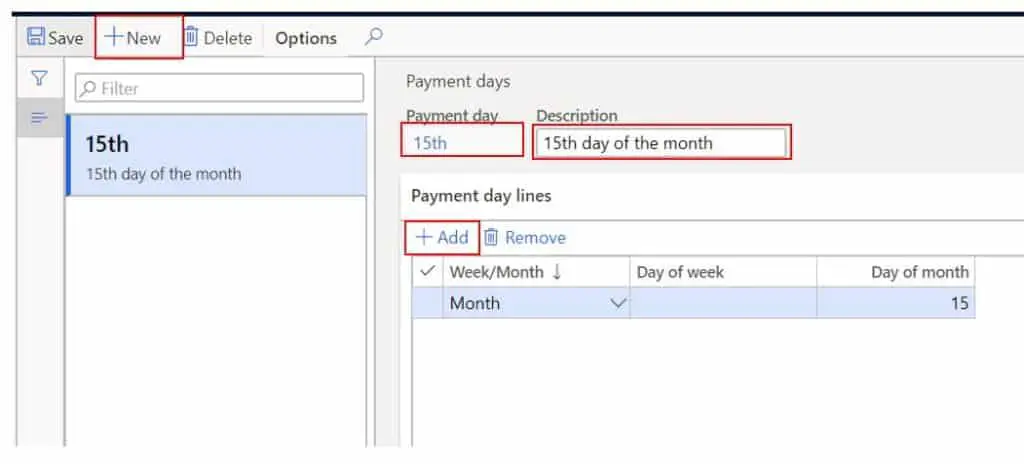

- To create a new record, click the “New” button and enter payment day ID.

- Give the payment ID a description.

- In the “Payment day lines” section click the “Add” button to create a line.

- In the “Week/Month” field select whether the payment day has a weekday requirement or day of the month requirement.

- If you select “Week”, select the “Day of the week” the payment day should fall on.

- If you select “Month” enter the day of the month the payment date should fall on in the “Day of the month” field.

Now we have our payment day. Next we will take a look at where the payment day can be linked and defaulted to specific transaction lines to automatically calculate the correct due date.

Payment Terms

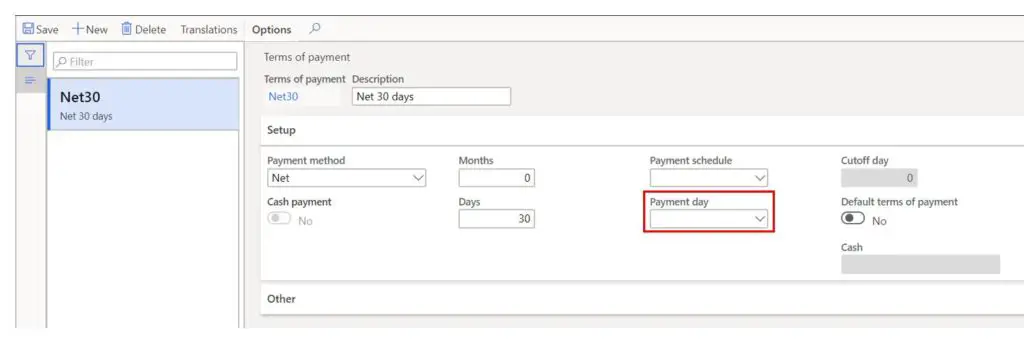

In this post I will not go through the entire payment terms form and setup, but suffice it to say that the payment terms is the main driver of the due date calculation for invoices. In the example I will show below, I have set up a Net 30 payment term which means that the total invoice amount is due 30 days from invoice date. As you can see, I can also associate a payment day with the payment terms so any vendor with this payment term will also inherit this payment day which will contribute to the due date calculation as I will demonstrate later in the article.

Vendor

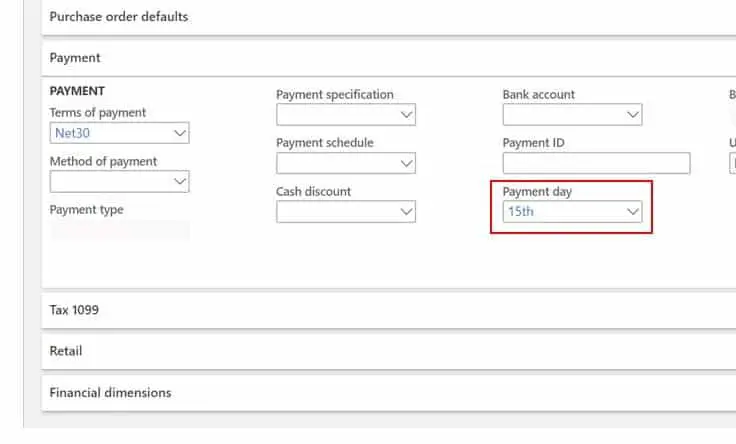

The payment day can also be defaulted directly from the vendor to transactional documents like purchase orders. This will help to automate and customize the due date calculation by vendor when that vendor is used in an invoice transaction.

Scenario 1: Net 30 Without Payment Day

In the following scenarios I will be using a standard invoice journal to demonstrate the due date calculations with different variations and combinations of payment terms and payment days setup. This first scenario will just use the payment terms with no payment day. This way we can isolate different variables and see the effect of each change.

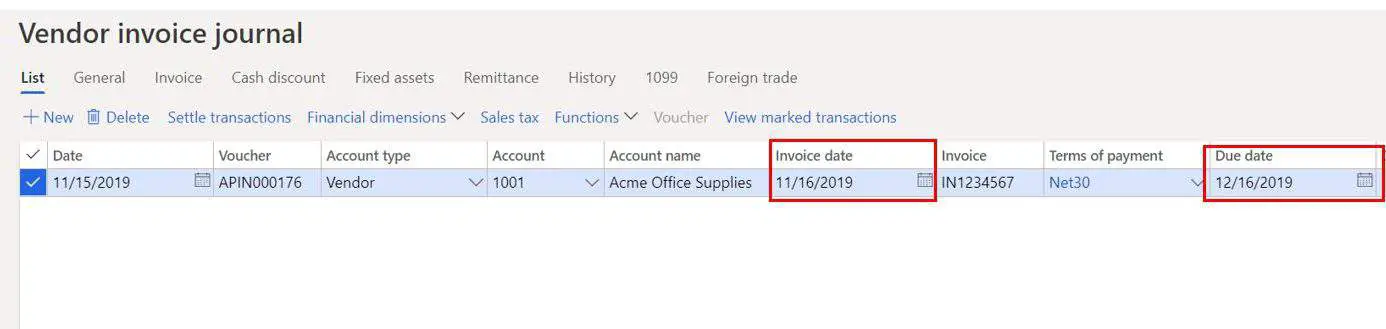

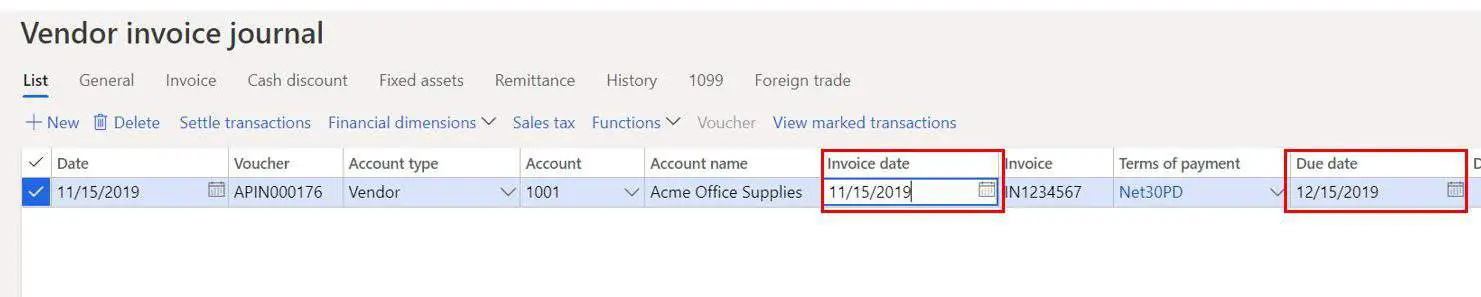

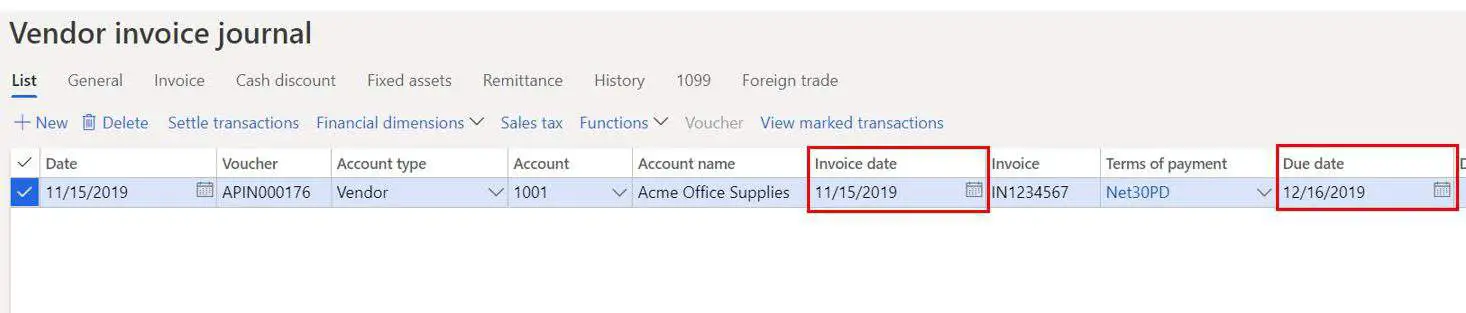

Below is a vendor invoice journal line where the invoice date is 11/16/2019 and the payment terms is set to “Net30”. The calculated invoice date is 12/16/2019 because it uses 11/16/2019 plus 30 days.

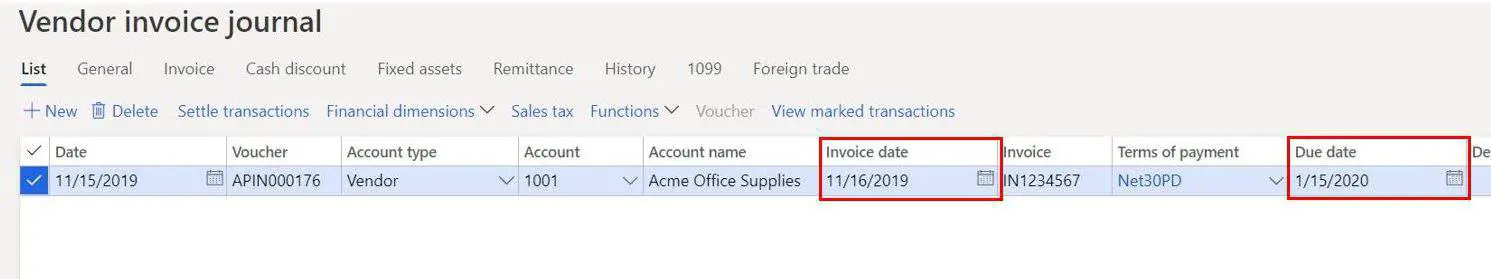

Scenario 2: Net 30 With Payment Day (Day of the Month 15)

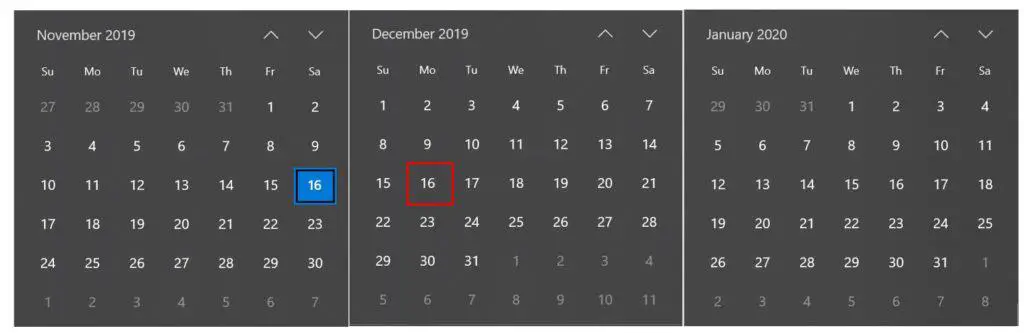

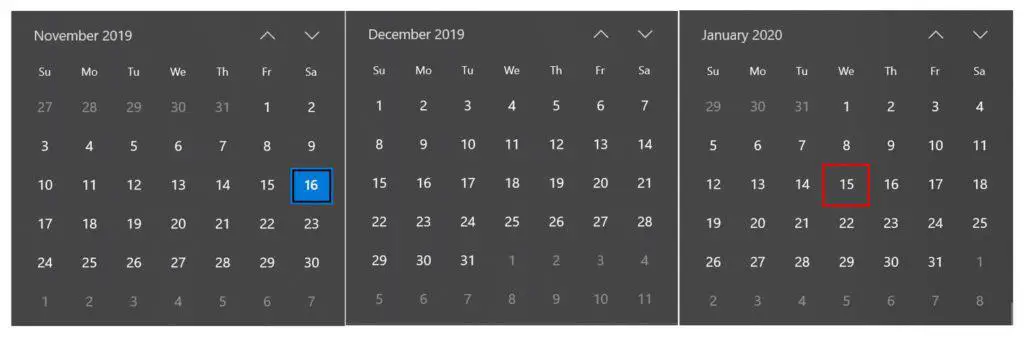

In the following scenario we will change the payment terms to “Net30PD”. This payment terms has the same setup as the “Net30” payment terms except it also has the “15th” payment day associated with it. As we saw the “15th” payment day specifies that the payment day should fall on the 15th of the month.You can see that when we set the invoice date to be 11/16/2019, the due date is calculated to be 1/15/2020. Here’s why. It takes 11/16/2019 and adds 30 days which gives us 12/16/2019 but we specified that the payment date must fall on the 15th of the month so next date that falls on the 15th is 1/15/2020.

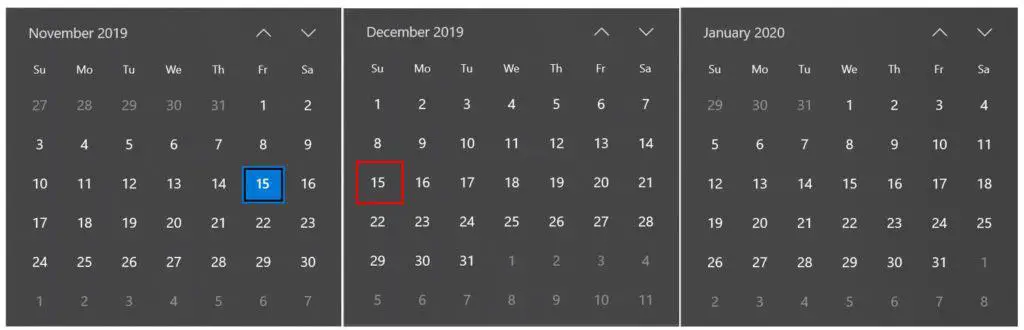

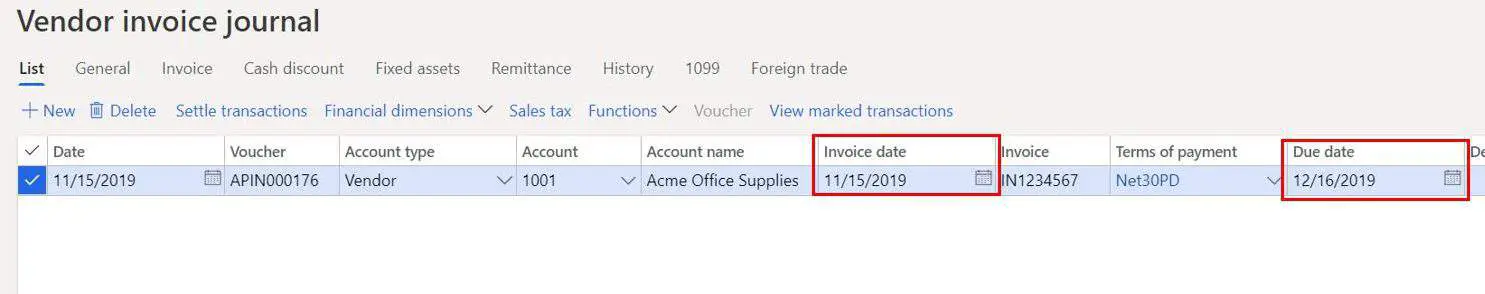

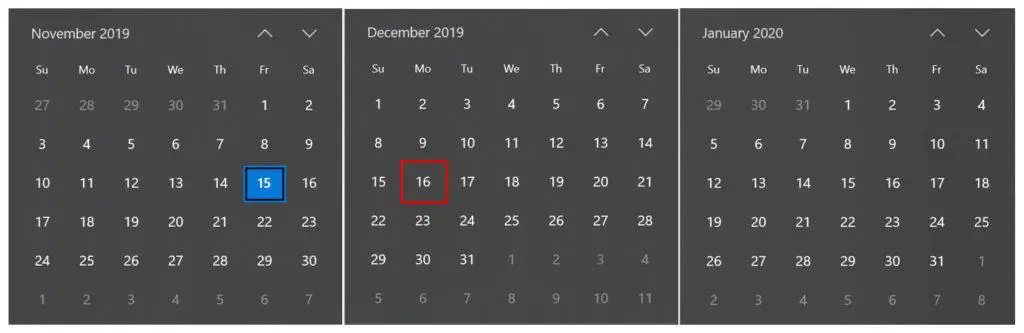

You can see that when we set the invoice date to be 11/15/2019 the calculated due date is 12/15/2019 because 12/15/2019 is 30 days from the invoice date and it happens to also fall on the 15th day of the month.

Scenario 3: Net 30 With Payment Day (Day of the Month 15 and Day of the Week)

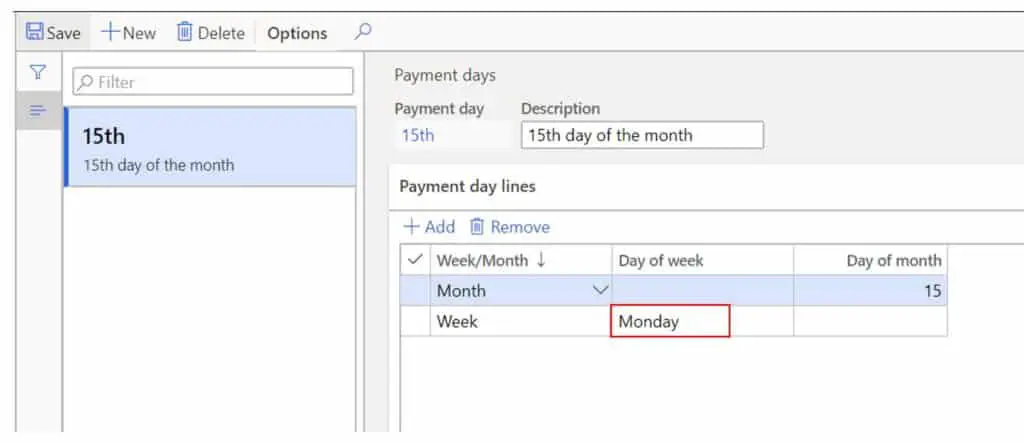

In the following scenario we will keep the same payment terms (“Net30PD”) but we will add a record to the “Payment day lines” section to further specify that the payment day must also fall on a Monday.

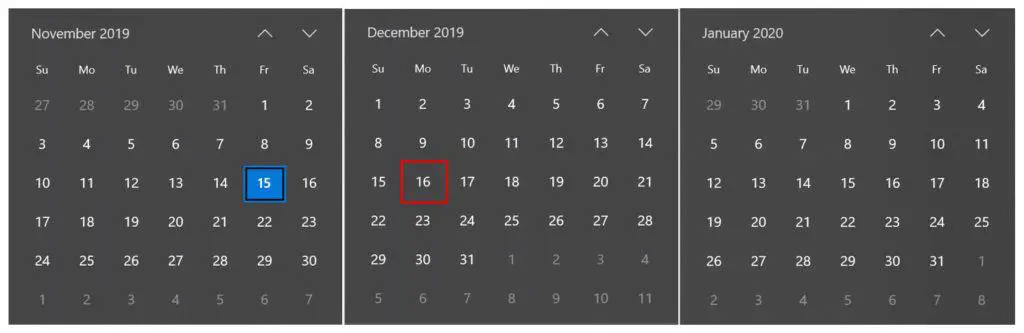

If we set the invoice date to be 11/15/2019 the calculated due date is 12/16/2019. This is because 30 days from 11/15/2019 is 12/15/2019 plus the requirement to fall on the 15th plus the requirement to fall on a Monday. 12/15/2019 does not fall on a Monday but 12/16/2019 does which fulfills the second requirement.

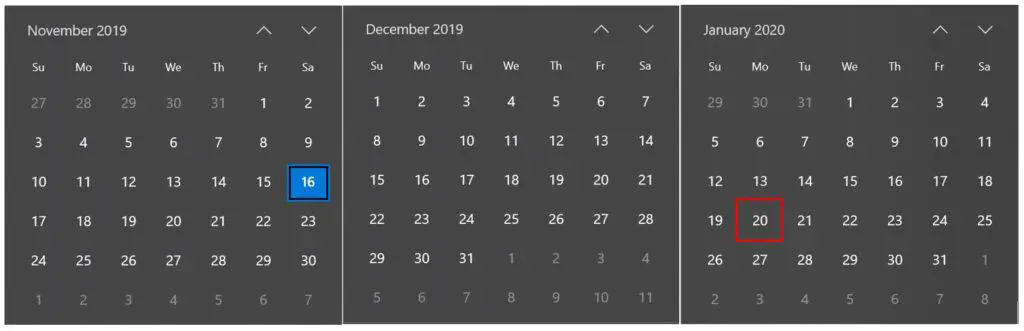

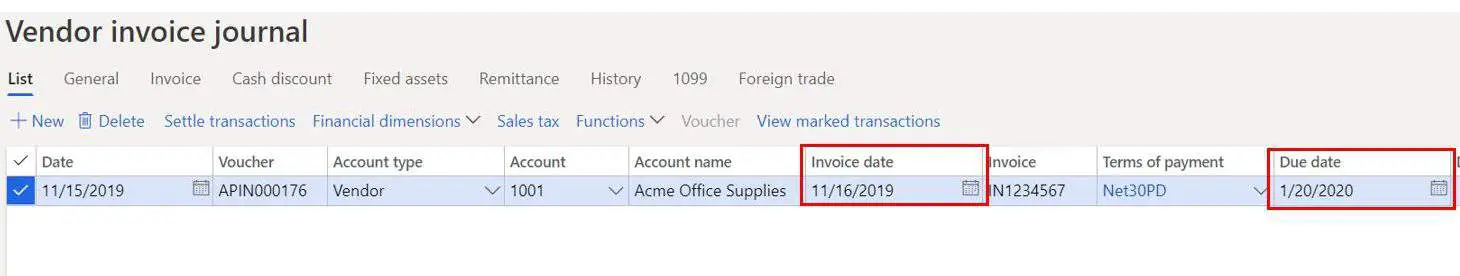

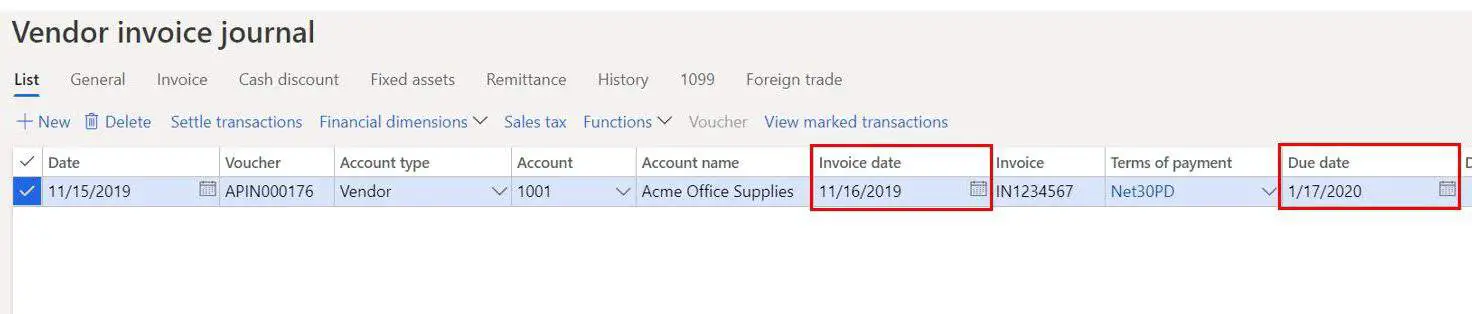

Now if we change the invoice date to 11/16/2019 you can see that the new calculated due date becomes 1/20/2020. This is because 11/16/2019 plus 30 days is 12/16/2019 so we have already past the 15th day of the month, so the next 15th day of the month is 1/15/2020 but this falls on a Wednesday so the next day that falls on a Monday is 1/20/2020.

Scenario 4: Net 30 With Payment Day (Day of the Month 15 and Day of the Week and Secondary Day of Week)

We’ve seen what happens when you have a payment terms, with a payment day, with day of the month requirements and day of the week requirements, but what happens if we add another day of the week requirement? I’ve gone back and added another “Week” record to the “Payment day lines” for Friday. Let’s see what happens.

If we set the invoice date to 11/15/2019 you can see that the new calculated due date is 12/16/2019. This is because 11/15/2019 plus 30 days is 12/15/2019 and then we take our Monday requirement and we land on 12/16/2019. So this means that adding the day of the week requirement is the equivalent of an “OR” statement in our calculation. This is more apparent if we change the invoice date to 11/16/2019.

When we change the invoice date to 11/16/2019 the calculated due date becomes 1/17/2020. This is because 11/16/2019 plus 30 days is 11/16/2019 but we need to land on the 15th so the system looks for the next 15th day of the month but that day is a Wednesday, so it looks for either the next Monday or Friday and it happens that the next Monday or Friday lands on 1/17/2020.

Takeaway

I hope this has given you a clear illustration on the “Payment day” functionality. Even though the example was on the AP side, the same functionality applies on the AR due date calculation as well. Sometimes it is easier to see concrete examples rather than a written definition of the functionality and I hope this will give you what you need to configure and use Payment days effectively.